Description

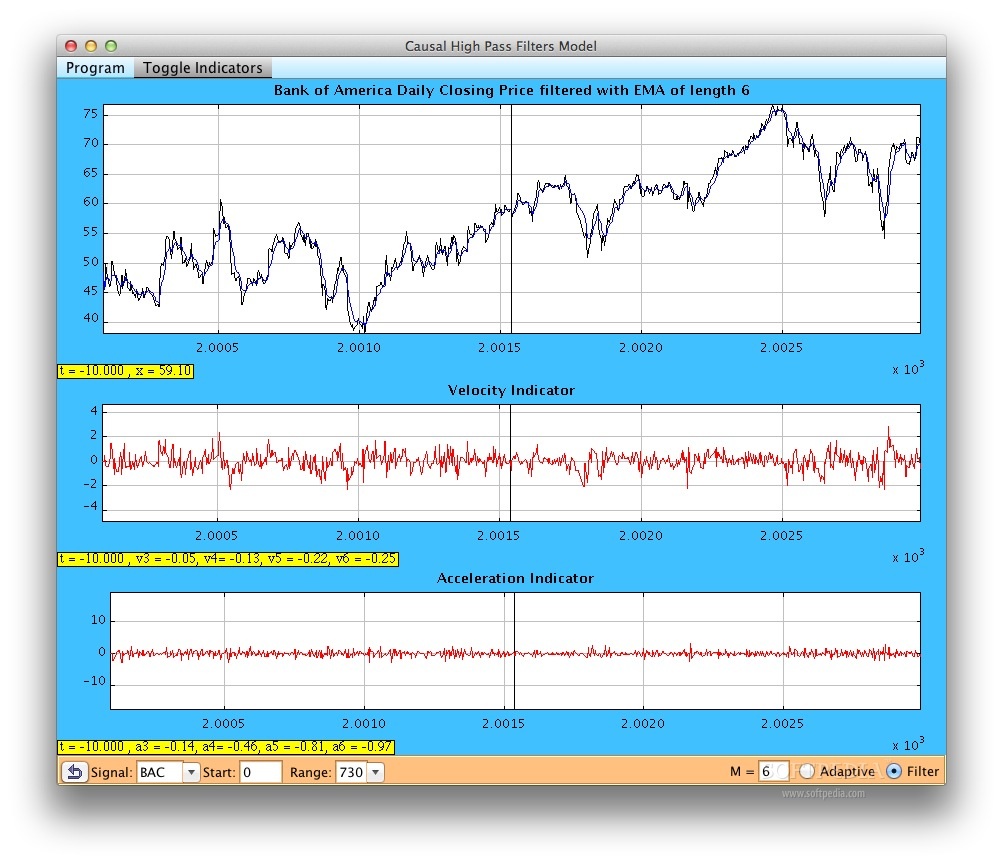

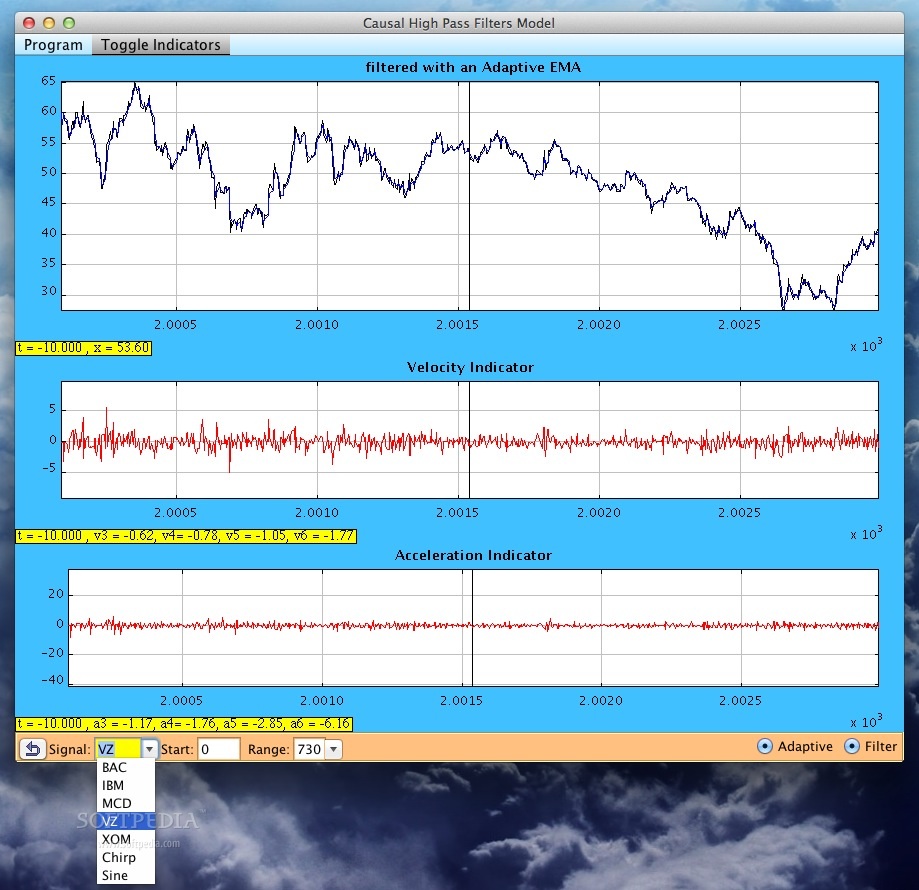

Causal High Pass Filter Model is a simulation that was built to determine how fast the market is moving, based on stock market data.

The simulation includes different order indicators, which the user can analyze in order to find their sensitivity and accuracy.

Causal High Pass Filter Model is developed using the Java programming language and can be run on Mac OS X, Windows and Linux.

User Reviews for Causal High Pass Filter Model FOR MAC 2

-

for Causal High Pass Filter Model FOR MAC

Causal High Pass Filter Model FOR MAC is essential for analyzing market movements accurately. A must-have for traders and analysts.

-

for Causal High Pass Filter Model FOR MAC

Causal High Pass Filter Model FOR MAC provides valuable insights into market movement with diverse order indicators. A useful tool for stock market analysis.