Description

Managing your company’s payroll can prove a daunting task, even if the number of employees is not too high. However, there are solutions to the problems, as many programs can simplify your job and make it easier to determine tax-related details, or National Insurance obligations.

Basic PAYE Tools is a complex and effective application determined to help you dealing with the payroll side of your business, offering various features and functions so you can perform your task more time-efficiently.

The main window of Basic PAYE Tools corresponds to the ‘Home’ tab in its interface, where employers and employees can be added and their information managed.

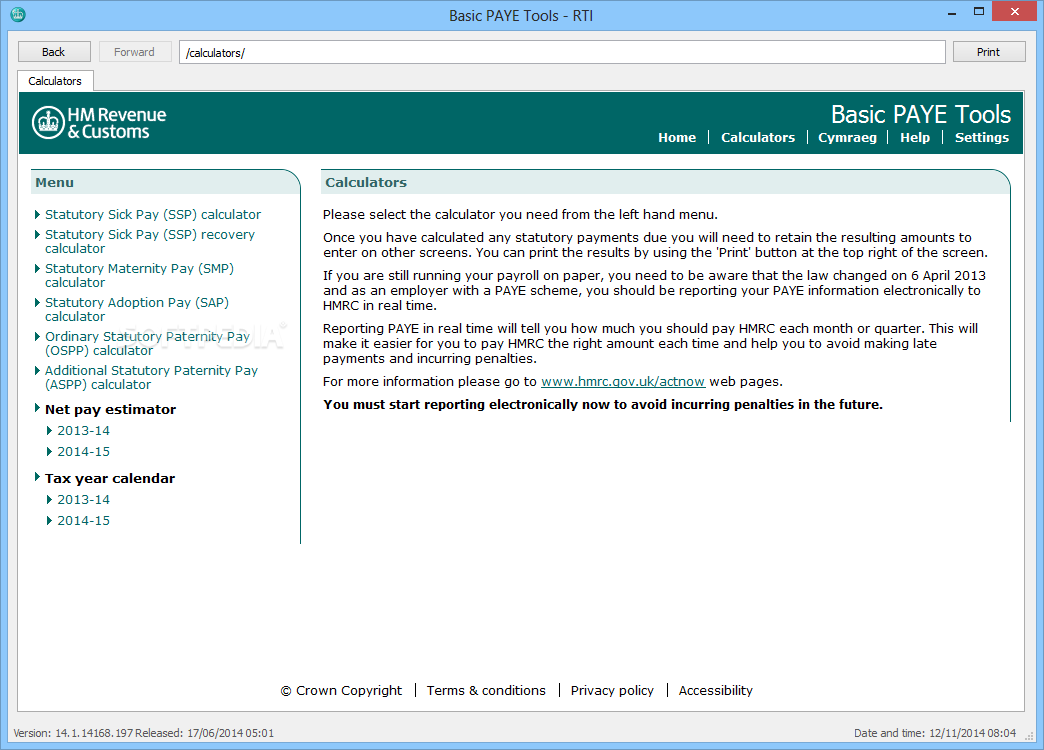

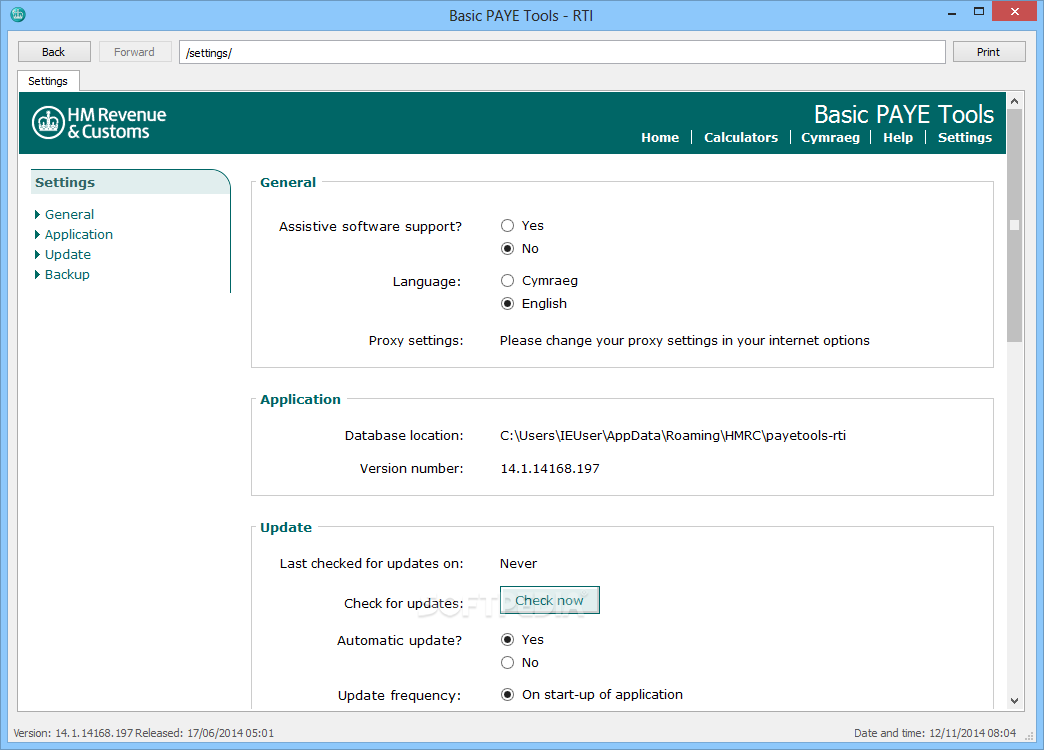

A series of calculators can be found in the homonymous section while the ‘Settings’ area allows you to customize its functioning parameters.

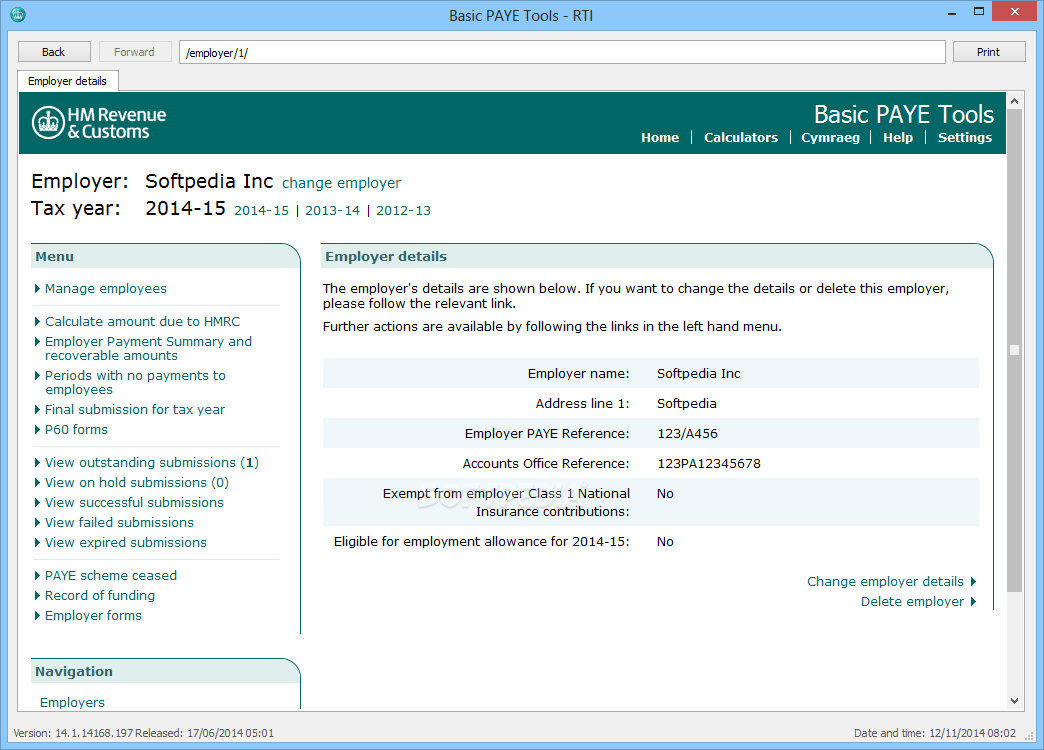

Firstly, you will need to provide the employer’s details, bearing in mind that it must be registered with the HMRC, since the reference number needs to be provided as well, along with other NICs Employment Allowance information.

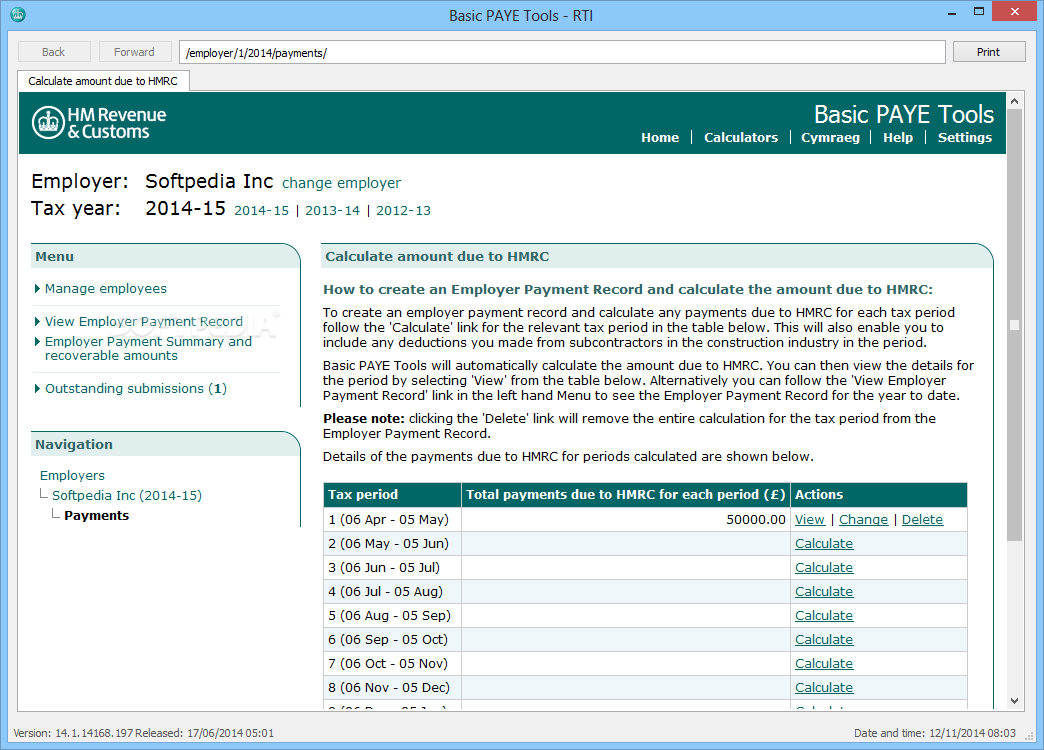

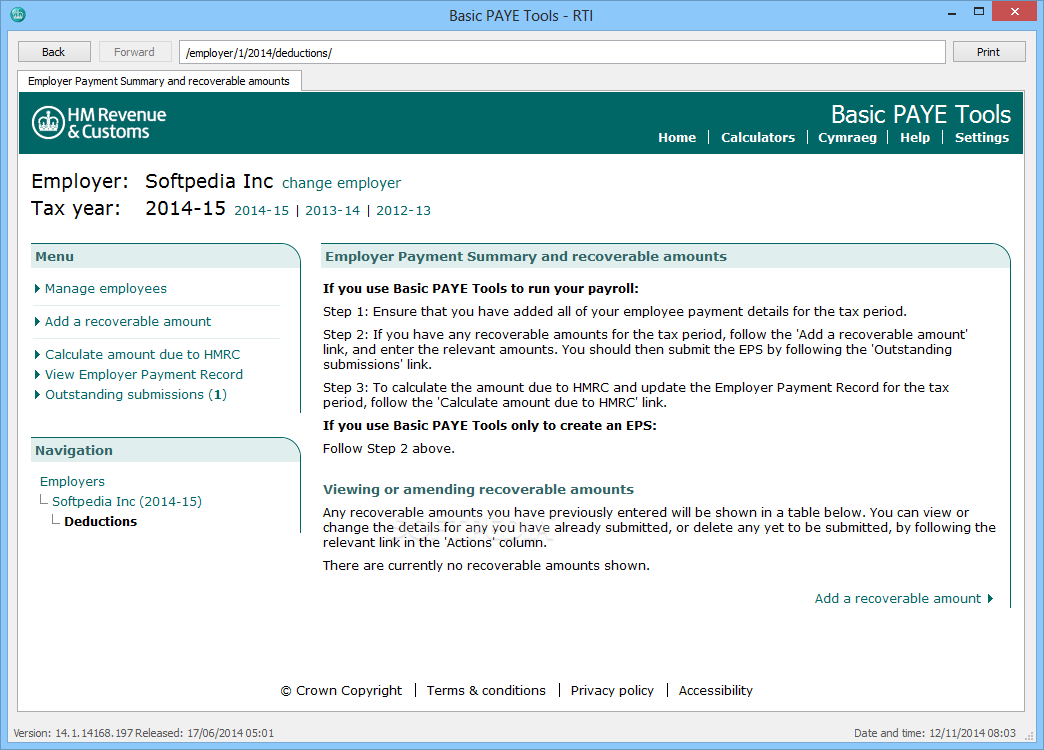

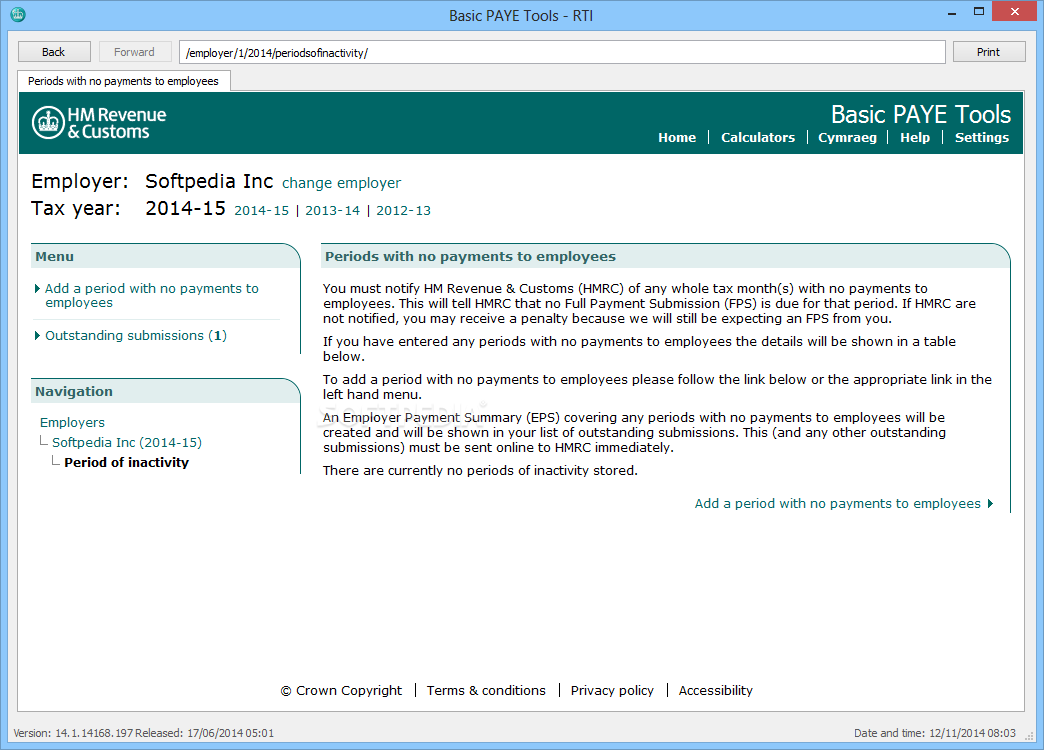

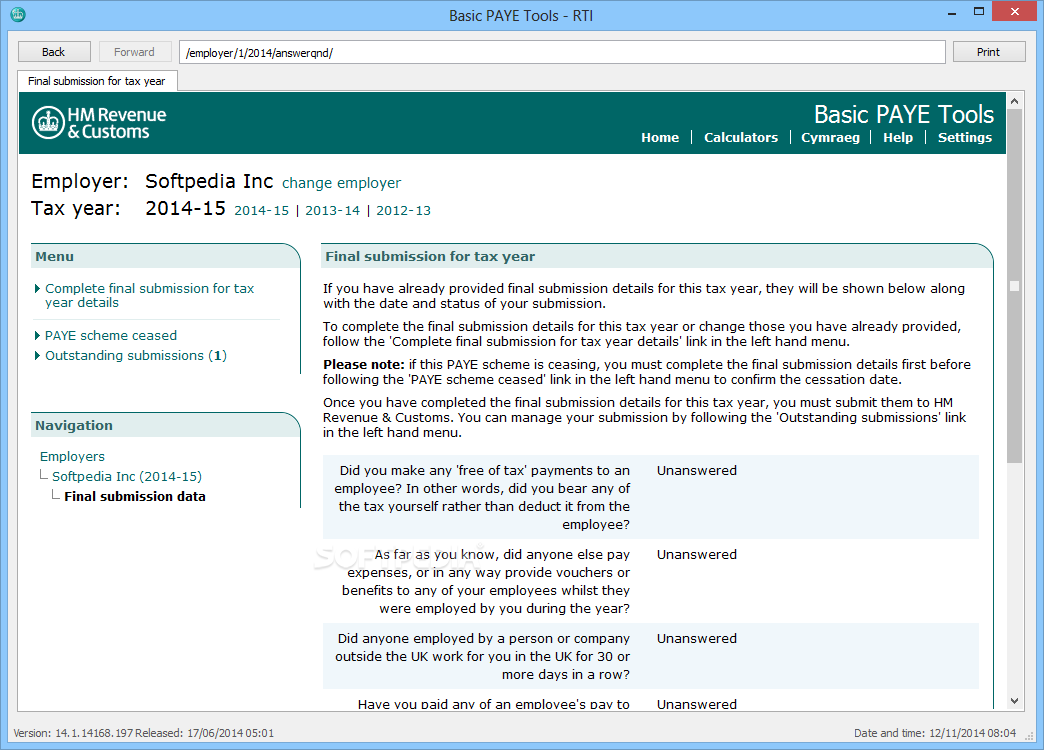

Moreover, you can manage employees, calculating their monthly payments, deductions, periods of inactivity, yearly tax submission forms, and other such data, for each individual working in the company.

With the help of the ‘Calculators’, you can determine ‘Statutory Sick Pay’, ‘Statutory Maternity Pay’, ‘Ordinary Adoption Pay’ and other payments that you may need to issue, as well as work with the ‘Net Pay Estimator’ to determine, in rough, how much money you will be required to use every fiscal year, for employees.

In conclusion, Basic PAYE Tools is a feature-rich and effective software solution that can significantly reduce the amount of time you need to spend on calculating employee payments, tax returns and deductions, for your company.

User Reviews for Basic PAYE Tools FOR WINDOWS 1

-

for Basic PAYE Tools FOR WINDOWS

Basic PAYE Tools FOR WINDOWS simplifies payroll tasks, offering calculators and customizable settings. Highly recommended for efficient employee payment management.